How it works

Mary applies for her first credit card. Mary's credit report lacks the data needed for underwriting. Mary is declined.

The credit card issuer who declined Mary's application invites her to find a credit card using Scorenomics' BeyondMyScore.

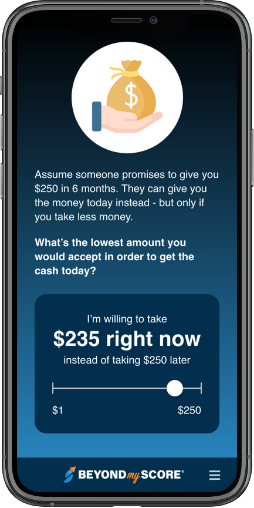

Mary answers a few questions regarding her financial situation, her financial knowledge and how she would solve various financial problems.

Using this new information, Scorenomics' risk model predicts that Mary will be a responsible borrower. Scorenomics matches Mary to various other credit cards similar to the one for which she originally applied.

Mary applies for a credit card from one of Scorenomics' partners for which she has high odds of being approved.

Because Mary has a low Scorenomics' risk score, her application is approved even though a traditional credit score could not be calculated from her credit report.