Creditworthiness is about more than payments

Transaction-based underwriting helped lenders augment how they see consumers. We believe consumer contributed data will be the next big orthogonal source of data.

Scorenomics creates variables reflecting:

Specific situation

What's the human context of a consumer's finances? Are they a recent graduate starting a career, or someone recently divorced?

Financial literacy

How well does a consumer understand financial topics that affect them.

Value system

What's the consumer's philosophy when it comes to personal responsibility or holding debt?

Mindset and behavioral patterns

Does the consumer believe they have the potential for self-improvement? Can they make rational decisions despite stress?

Collected from consumers

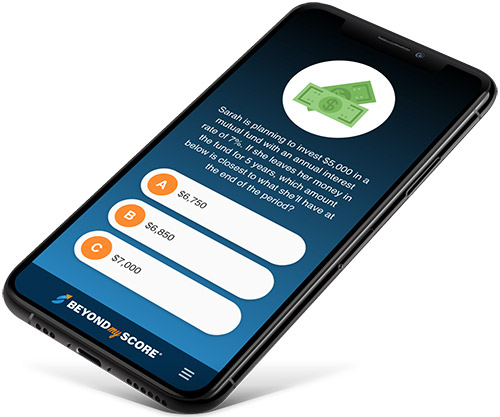

We assess creditworthiness based on how consumers answer simple questions

Ungameable

We take a complex, multi-layered approach to ensuring data accurately reflects ability to repay

Research-based

Data reflects the latest understanding from academic and industry research

Orthogonal

Consumer contributed data can segment within bands created with advanced algorithms, traditional and alternative data

Road tested scores

All of our leads come attached with a Scorenomics risk rating generated by observing real payment performance of consumers who contributed data.